Our recommendations to the Nova Scotia government

On Friday, February 3rd, the Halifax Chamber of Commerce submitted our 2023-2024 Provincial Pre-Budget Submission to the Hon. Allan MacMaster, Nova Scotia Minister of Finance & Treasury Board.

The goal of this pre-budget submission is to reiterate the importance of the positive changes happening in our community alongside recommendations that would provide value to our businesses, improve the lives of Nova Scotians, and increase our province’s economic growth.

Our list of recommendations was generated through Chamber task force meetings, discussions with our event attendees and members at round tables and events, and through countless hours of calls each month where we connect with our membership.

Overview

Our economy is going through a transitional phase, and businesses are adjusting to new economic realities. Our members are facing a variety of challenges from increasing inflation and labour shortages, to supply chain disruptions and rising interest rates. Despite this, there have been actions, ideas, and outcomes that have resulted in positive change for the business community. Focusing on key issue areas, our submission highlights ways to improve our fiscal position, housing supply, population needs, and economics.

Recent issues in areas like housing and health care have highlighted the ways that social issues can impact the business community. Nova Scotia reached a milestone population of over one million people, with immigration playing a large part in the record growth. Improving standards and streamlining the immigration process is key to economic growth, addressing our labour shortage issue, and encouraging diversity, equity, and inclusion within the province. We all benefit from this growth with a greater tax base, new businesses, jobs, and greater diversity and culture. Key infrastructure is necessary to retain the influx of new Nova Scotians, like adequate health care and affordable housing.

Below are a few of our key recommendations to government for 2023-2024.

Optimizing the size of government

The Chamber advocates for the optimization of the size of government. The Chamber is asking the government to look for new ways to be more efficient and effective with the current level of financial resources. In the most recent forecasts, the government is expecting a windfall of revenues due to the rapid economic recovery and rising inflation. Because of this, many provinces are slashing the size of their deficits or growing surpluses, leaving them in a better position than they were. Even though Nova Scotia had a $1.3 billion windfall in revenues, we still failed to fully eliminate this year’s deficit of $506 million, recording a $130 million deficit at the end of the year. We know that today’s debt becomes tomorrow’s taxes, and Nova Scotian businesses already pay some of the highest tax rates in the country.

Taxation

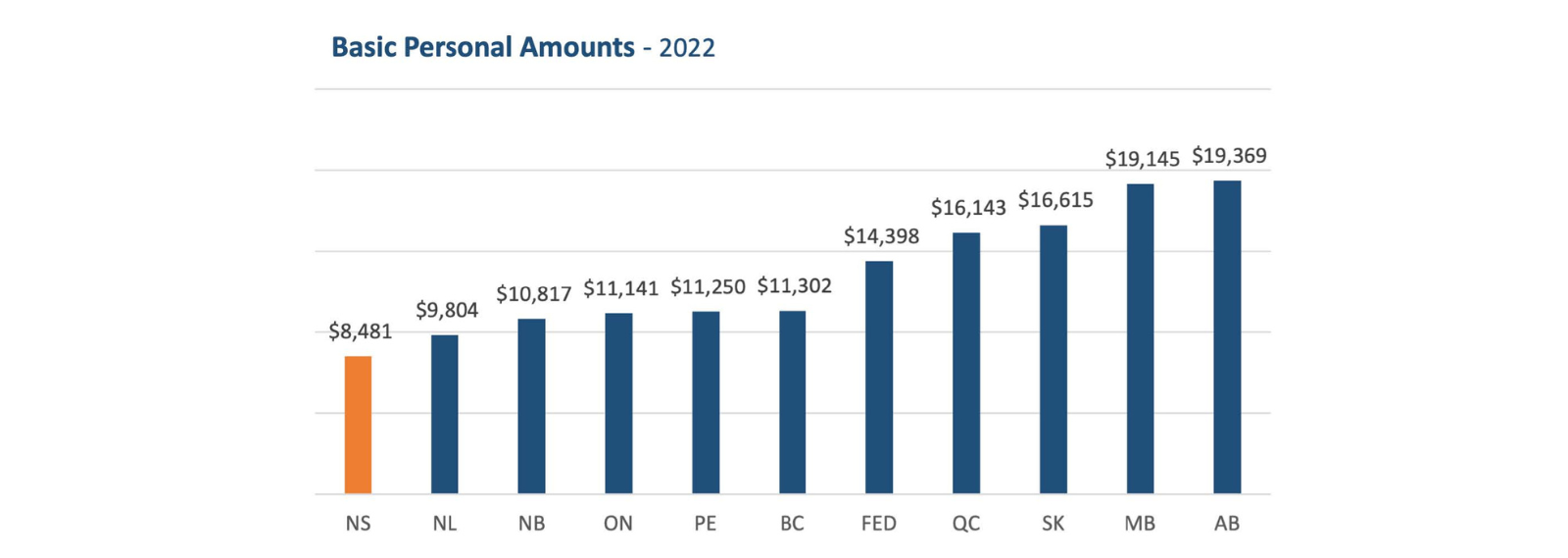

The Basic Personal Amount (BPA) in Nova Scotia is one of the lowest in Canada at $8,481. Increasing the basic exemption to a national average is an easy way to support low-income earners. Rather than raising the minimum wage rate, increasing the BPA allows low-income earners an opportunity to keep more of their employment income, while limiting the effect of increasing labour costs on the business community. Low-income earners will be able to allocate those savings more efficiently than a government program. Additionally, the BPA should be indexed to inflation to account for changes in real incomes. Alberta, Nova Scotia, and PEI are the only provinces that do not use indexing for their personal income tax system.

Recommendation: Increase the Basic Personal Amount (BPA) to the national average and begin to index the BPA to the Consumer Price Index (CPI) every year to support lower-income earners while limiting the effect of increasing labour costs for small businesses.

Housing

Ensuring Nova Scotia can supply people with a place to work, live, and play is the only way we are going to continue attracting and retaining talent. While we have seen, through the pandemic, that Nova Scotia is a desirable location for many from outside our province, it is becoming apparent that for some, the ability to live in this province is waning, due to rising housing costs and lack of housing supply. For the past four years, the Chamber has been advocating for an increase in municipal powers to support housing, and for changes to the Capped Assessment, and the Rent Cap programs. While we are happy to see the province has taken steps to address some of the barriers to housing supply by supporting the joint task force on housing in HRM, and investments into affordable housing, more needs to be done to accommodate the expected growth in population.

Capped Assessment Program

The Chamber has asked for several years that the Capped Assessment Program (CAP) be reviewed for effectiveness. The CAP distorts the property tax system, shifting more of the tax burden on first-time homeowners and renters, reducing the potential amount of municipal revenue, and impacting housing affordability. The more the residential tax ratio increases, the greater it impacts our members. It is noted that “if residential properties were taxed at market value, the city could lower the residential tax rate.” We hope that this reduction would also be reflected in the commercial tax rate to ensure businesses are treated fairly. We would still like to see protection tools in place for those with lower or fixed incomes who would be greatly impacted by the dissolution of the CAP.

Recommendation: Implement the Nova Scotia Federation of Municipalities’ proposal to the All-Party Cap Committee in 2020 which proposed a phased-out approach for the capped assessment program. Otherwise, provide empirical evidence of the success of the program.

People

The Chamber is in support of the ambitious goal of two million people in Nova Scotia by 2060. More Nova Scotians equates to a larger tax base, ultimately saving individuals from increased taxation and keeping service and program levels steady. For many, this goal may seem unachievable or lofty, and while we have work to do to ensure these people can find safe and affordable homes and well-paying jobs, we know that the alternative — not attracting newcomers — would impact not only our budget but also our local supply chains and our businesses’ ability to find employees. Through immigration, an enhanced focus on our workforce needs, and ensuring a lens on diversity, equity, accessibility, and inclusion, we can grow our province – in both people and economic generation.

Immigration

To reach the goal of two million people in Nova Scotia by 2060, we will need to partner with the Federal government to ensure programs and immigration rules allow for more newcomers and faster, more efficient application and accreditation processes. We are glad to see that Minister Fraser’s recent immigration plan calls on the Atlantic Immigration Program to double the size of its stream to 14,500 nominees, with a focus on targeting foreign trade and construction workers. The provincial government should continue to meet with federal partners to acquire further supports to reduce red tape and increase immigration numbers and skills/training programs.

The business community can also be a wealth of knowledge for government, understanding the skills and training that will be necessary for the most in-demand jobs.

Recommendation: Collaborate with the Federal government, Municipalities, Atlantic Immigration Pilot, and ISANS to further expand and expedite immigration targets through ‘Targeted Streams’ of the most in-demand jobs (construction & health care).

Business Support

Businesses across all sectors are dealing with a multitude of issues like inflation, labour shortages, rising interest rates, and increased taxation. Despite their resiliency, businesses require support through programs, services, and funding options that can assist them through these unpredictable economic times. Improving local economic development has been shown to increase living standards, increase real incomes, and provide local governments with the ability to devote more resources to areas like health care and education. Uncertainty creates risk, and risk negatively impacts business investment. The biggest factor for promoting economic development is sustainability and predicted economic growth. Our recommendations below outline a few steps the province can take to increase the sustainability and predictability of our provincial economy.

Tourism & Hospitality

With the province having consolidated the Crown Corporation that was Tourism NS back inside a government department, the Chamber is concerned that the sector may lose even more visibility and support. Labour shortages are at an all-time high and the tourism and hospitality sector is one of the hardest hit sectors related to labour. In addition, the Halifax International Airport Authority (HIAA) is forecasting a slowdown in air travellers due to the expected recession, further impacting the tourism sector. In 2020, Halifax Stanfield served 995,426 passengers, down from 4,188,443 in 2019.

Recommendation: The tourism sector continues to be disproportionately impacted by global economic factors, and it will be one of the last sectors to fully recover. Continued financial support for this sector is critical.

Recommendation: The airport is a significant economic generator, contributing roughly $3.8 billion annually to the provincial economy. Providing adequate financial support to the HIAA is critical to supporting the provincial economy and many sectors that depend on the trade and travellers that pass through the airport.

Conclusion

The above recommendations are only a sample of our full Pre-Budget Submission. The full submission highlights some of the most pressing issues we are hearing from the business community. Read our full submission for more ideas on how the government can support Nova Scotians through fiscal sustainability, housing options, reduced barriers, support for our most affected sectors, and ensuring all Nova Scotians are valued and heard.

Read the full 2023-2024 Pre-Budget Submission here!

Header Image Credit: Tom Flemming

< Back to Articles | Topics: Spotlight