If our news feeds have any similarities, you are likely inundated with talks of recessions, interest rate hikes, and labour shortages.

As a business owner, spending your precious time analyzing macroeconomic data is likely not a priority. So, we’ve picked a few key indicators that you should keep an eye on in the new year. Keep reading to discover how inflation, employment, population, and interest rates impact your business.

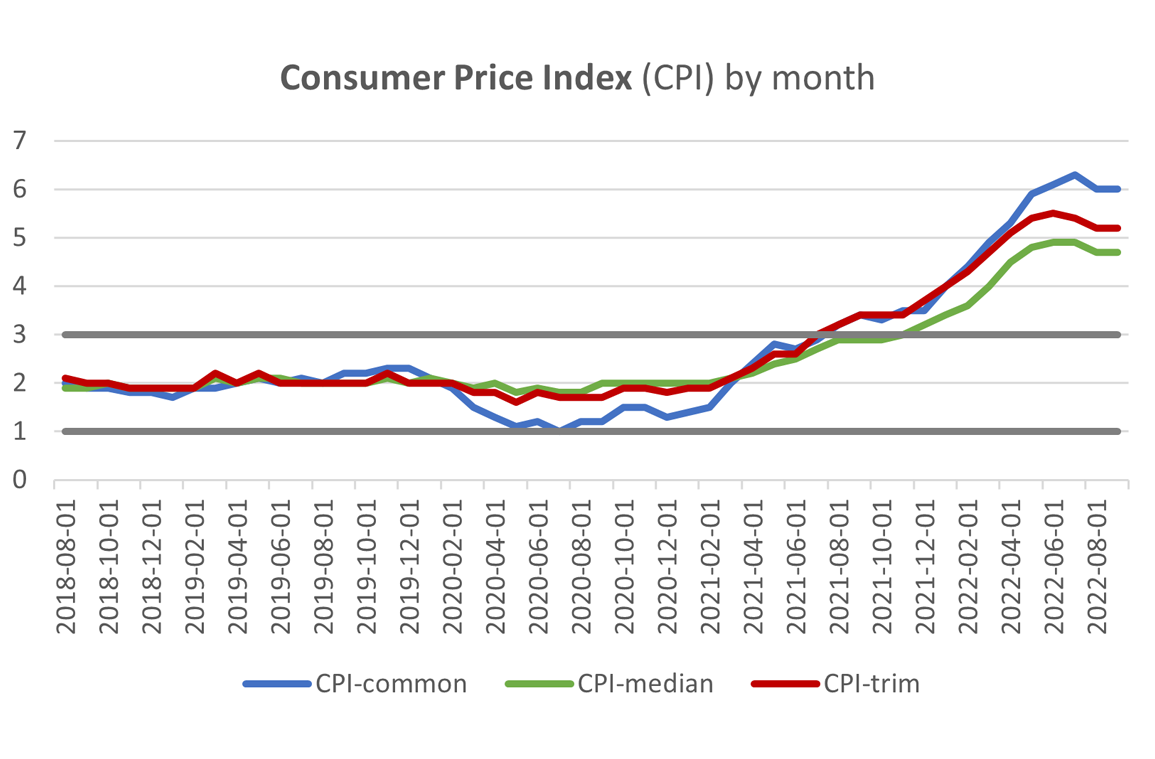

Canadian Inflation Rate

Significance: If there is an economic equivalent to the boogeyman, it's inflation. Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. The rise in prices, which is often expressed as a percentage, means that your money effectively buys less than it did in prior periods. How economists track inflation is generally through the Consumer Price Index (CPI) — it’s the most widely used measure of inflation. There are several factors that can contribute to rising inflation; today, we see inflation driven by increased consumer demand and supply chain issues. Simply put, as demand increases and supplies are limited, prices increase. The Bank of Canada (BoC) estimates that inflation should be back in the target range (2%) by the end of 2023.

Why it Matters: As things become more expensive and consumers’ real income declines, their ability to buy goods and services also declines. This can not only have revenue implications for your business, but wage implications for your workforce, as some employees may demand cost of living adjustments to offset their decline in real income. In addition, rising inflation triggers the BoC to increase the country’s benchmark interest rate in effort to combat rising prices. By doing this, it helps to slow demand, which allows supply to catch up and ease inflationary pressures. This, however, has negative implications on your cost of borrowing and debt servicing costs, as lenders tend to increase their rates as well.

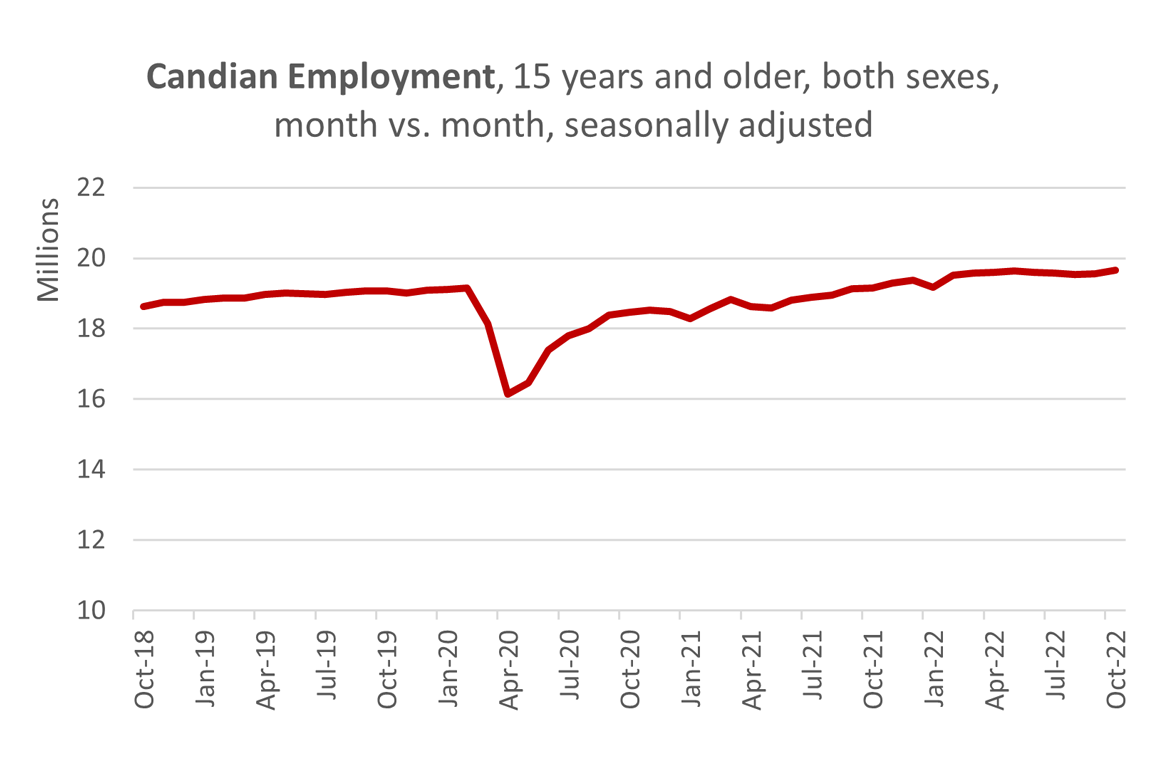

Canadian Employment

Significance: Being employed is a good thing — for an individual and for society. Beyond the obvious benefits of income and contributions to society through tax generation, being employed helps an individual’s wellness through socialization, fulfillment, and meaning. Conversely, elevated levels of unemployment impose high costs on the individual, society, and the country.

Why it Matters: As companies cope with diminished demand, declining profits, and elevated debt, many start to lay off workers to cut costs. When the economy is doing well, the opposite happens: companies need workers to meet the increased demand, which is why you hear so much discussion lately on labour shortages across so many industries. Because of this, economists closely monitor employment numbers as a key indicator of recessions. Keeping an eye on national and provincial employment numbers will allow you to gauge the health of the economy. It can also provide insights into the labour market, which can help to guide your recruitment and retention efforts depending on the broader trends.

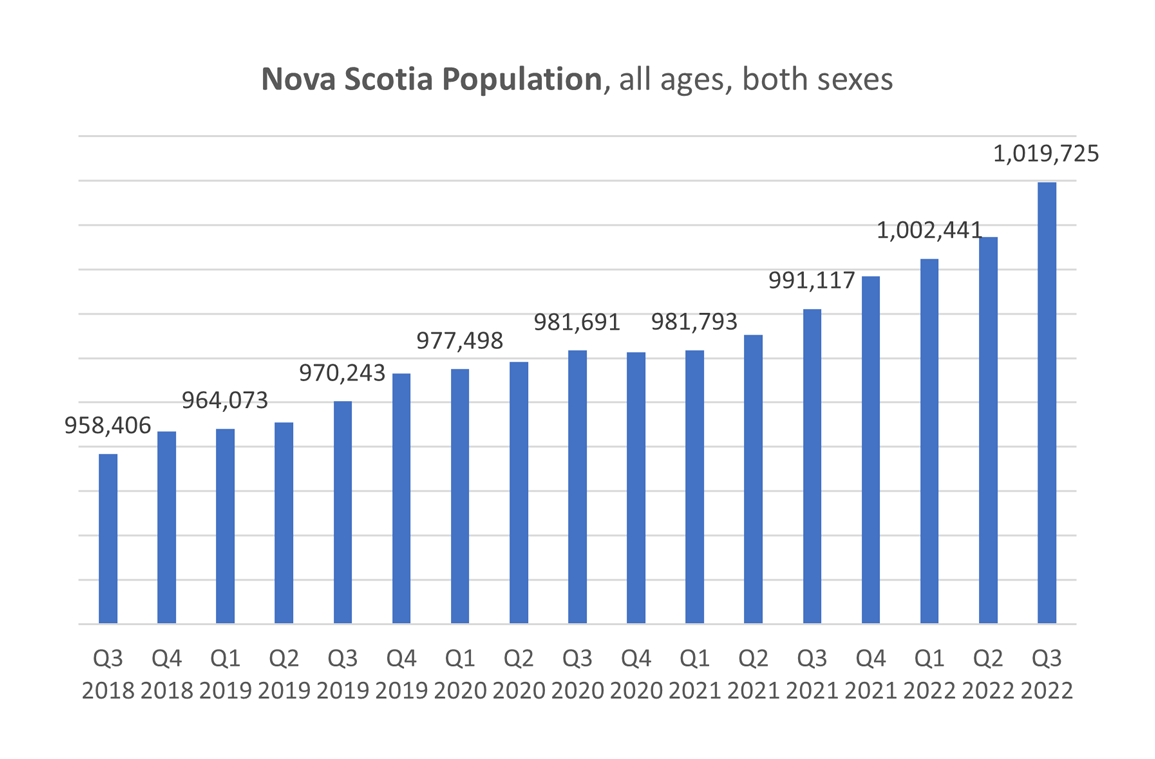

Nova Scotia Population

Significance: In the same vein as employment, having population growth is key to economic development and meeting the increased demand. Population growth leads to more access to labour, which will lead to higher productivity. This means more goods can be produced and increase output (GDP). More people in Nova Scotia will also lead to more demand for goods. Demanding and producing more goods will yield economic growth.

Why it Matters: As many industries grapple with a shortage of labour, attracting new bodies to the region is key to meeting demand. Nova Scotia’s aging population, along with our natural population change (births less deaths), puts continued downward pressure on Nova Scotia's population. Nova Scotia's extraordinary population growth over the last few years is attributable to a sharp increase in immigration as well as interprovincial migration. Attracting outsiders through both streams is important to addressing our labour shortages and for increasing economic output.

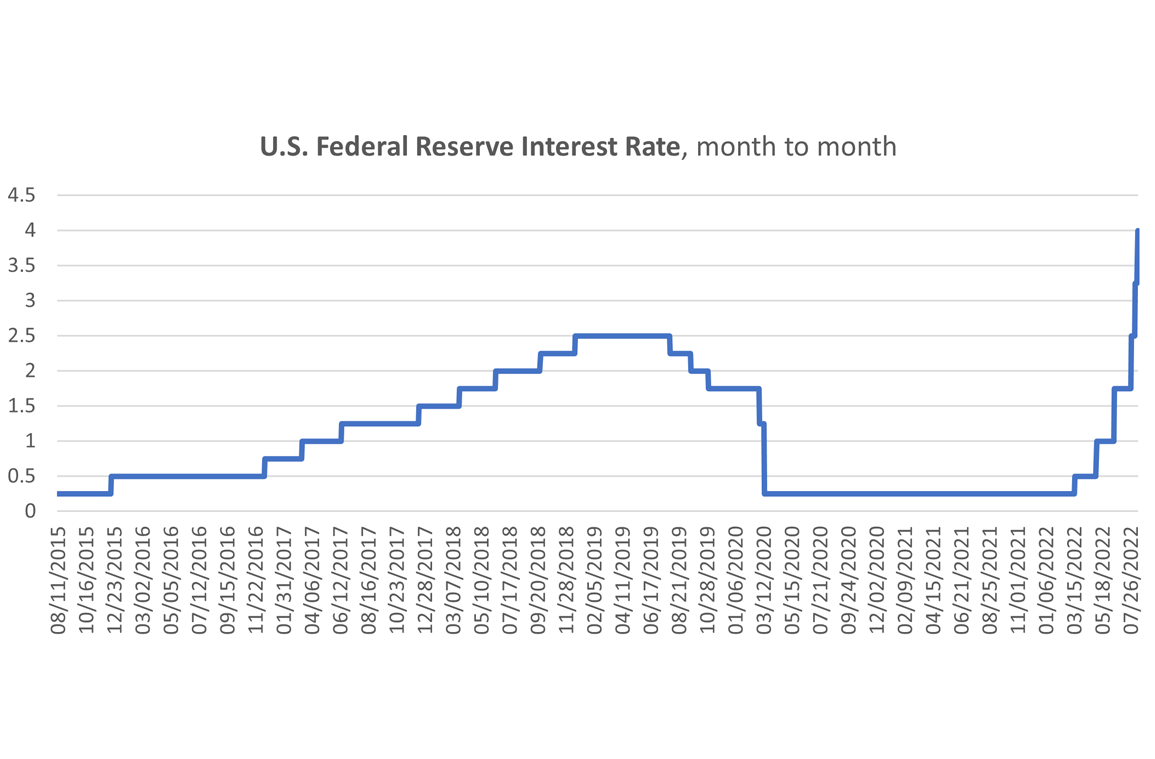

U.S. Federal Reserve Interest Rate

Significance: The U.S. Federal Reserve is the central bank of the United States and, much like the BoC, has one primary focus: managing and improving the overall economic health of the country. To do this, they must balance economic growth with employment through monetary policy. Monetary policy refers to the measures taken by central banks to influence the economy, like regulating the amount of money in circulation. One of the central bank’s greatest tools is setting the interest rate (overnight rate) for the country. They may raise or lower interest rates, depending on whether they are trying to heat up or cool down economic demand.

Why it Matters: Normally, Canada and the U.S. have monetary policies that move in similar directions. If U.S. interest rates go up, Canada’s rates will typically follow. The movements of U.S. interest rates have a critical effect on the Canadian Dollar. In 2015, the BoC cut the benchmark rate twice in an attempt to stimulate the economy, but when the U.S. Feds finally hiked their rate in December of that year, the loonie lost 16% of its value.

This is especially important for businesses that import or export goods and services. Relatively higher interest rates in Canada increase foreign investors’ demand for Canadian dollar-denominated securities, which can increase the value of the Canadian Dollar. For businesses that source their materials from foreign countries, a higher dollar value could mean lower prices on imports. Conversely, businesses that sell their products in foreign markets could receive less money from export sales. Monitoring both U.S. and Canadian rates provides clear indicators of our country’s battle against inflation, and it is also critical to businesses with cross-border operations.

Challenges for Businesses

In times of uncertainty, managing risk is a critical element for any business. Understanding the economy in the short-term through the indicators like CPI, interest rates, and employment rates will help you to better position your company for near-term economic shifts and shocks. Longer term shifts in demographics, sustainability, and digitization will also be key elements to pay attention to in order to capitalize on new opportunities and global shifts.

If you have any questions, concerns, or comments about how the economy is affecting your business, please reach out!

< Back to Articles | Topics: Working for you