What to watch as budget season begins

As we enter Budget season for the province, this year will be a particularly important one for all Nova Scotians to pay attention to as the economic conditions in our province are changing.

The Houston Government has had a track record of outperforming its own fiscal forecasts over the past few years. In multiple recent budgets, the government projected a deficit yet produced a year-end surplus. Thanks in part to an unexpected jump in taxes collected from historic yearly population growth.

Despite the recent surprise fiscal surpluses, this year may indicate a turning point. As our population growth slows down, we can no longer rely on windfall tax revenues to address our budgeted deficits, meaning the era of financial reprieves is behind us.

Last year for example, excess tax revenues allowed the province to spend more than $1.3 billion in additional appropriations, which is, money that was not budgeted and approved by the legislature.

Previous Minister of Finance Allan MacMaster said, despite consecutive years of bringing in more money than expected, the government intends to be careful with its approach to spending. With the scale of this year’s deficit however, it appears this cautious approach was not the chosen path forward.

The first update on the 2025-26 provincial budget in the fall shows Nova Scotia on track for a $1.2-billion deficit, a record number well above the $697-million deficit new Finance Minister John Lohr projected when he tabled the document last February.

According to Finance Minister John Lohr, the province will not be containing spending and said they will commit to see the province grow, indicating that the cautious approach to spending, suggested by the previous Finance Minister, is not on the horizon.

Minister Lohr also said that the economic prospects for Nova Scotia are very strong, citing eased restrictions on natural resources, and the provinces pitch for the Wind West project. While these advancements have significant economic potential, they are years away from being realized. Reading between the lines, we can expect that if our province does not intend to contain spending and our population growth is expected to slow, that our provincial debt is likely to balloon to a concerning level.

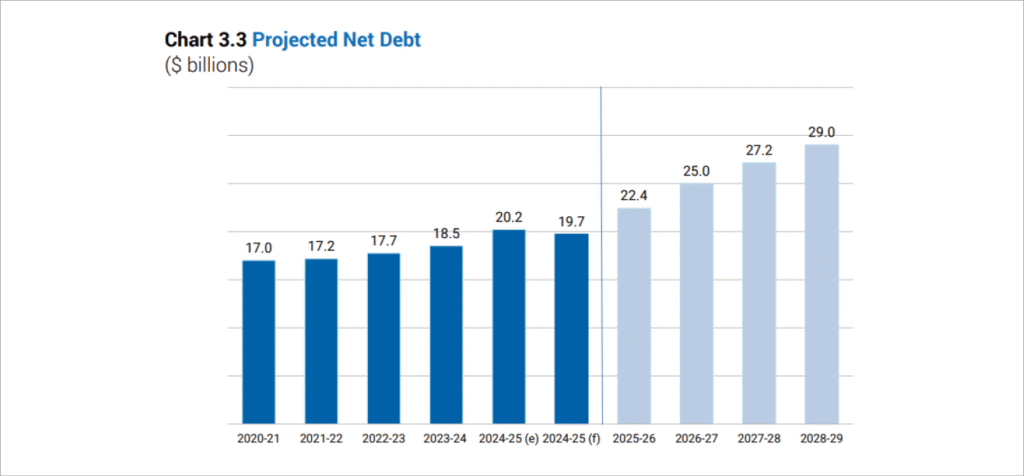

Currently, Nova Scotia’s debt sits at roughly $21B. From the time Premier Houston assumed office in the 2021/22 fiscal year to the end of this year, our provincial debt has risen by 25% from $17B to $21B and is projected to increase to $29B over the next 4 years (see chart 3.3).

Large deficits mean rapidly rising debt, and consequently, rapidly rising debt interest costs. Currently, the annual interest payments on our current level of debt are costing Nova Scotians nearly $1B every year, making it the 5th largest spending item in the budget.

One of the rationales for ballooning government debt is that if economic output can grow alongside the debt, a province can pay back its debts. This is commonly tracked by the debt-to-GDP ratio, which is a metric that compares a province’s public debt to its gross domestic product (GDP). It reliably indicates a province’s ability to pay back its debts by comparing what the country owes with what it produces. In Nova Scotia’s case, our Debt-to-GDP is projected to increase from 31% in 2024 to 40% in 2029, indicating our level of spending is outpacing its returns to economic growth.

Last year, the province was privileged enough to announce several business, personal, and sales tax relief measures due to their unexpected surpluses, a much-needed announcement for the most heavily taxed region in Canada. However, provincial budgets rely primarily on two ideas: taxes equal money in and spending equals money out. If more money needs to go out, we will need something to go in, and with cost of living and doing business being the number one issue among residents and businesses, they can hardly afford to be the ‘in’.